SIGNALS THROUGH THE NOISE: LATERAL MARKET REPORT

2025 didn't follow that predictable pattern. The ground shifted repeatedly beneath the industry, creating uncertainty that made planning feel like guesswork. For lawyers trying to make sense of what's happening now, predicting what comes next feels particularly challenging.

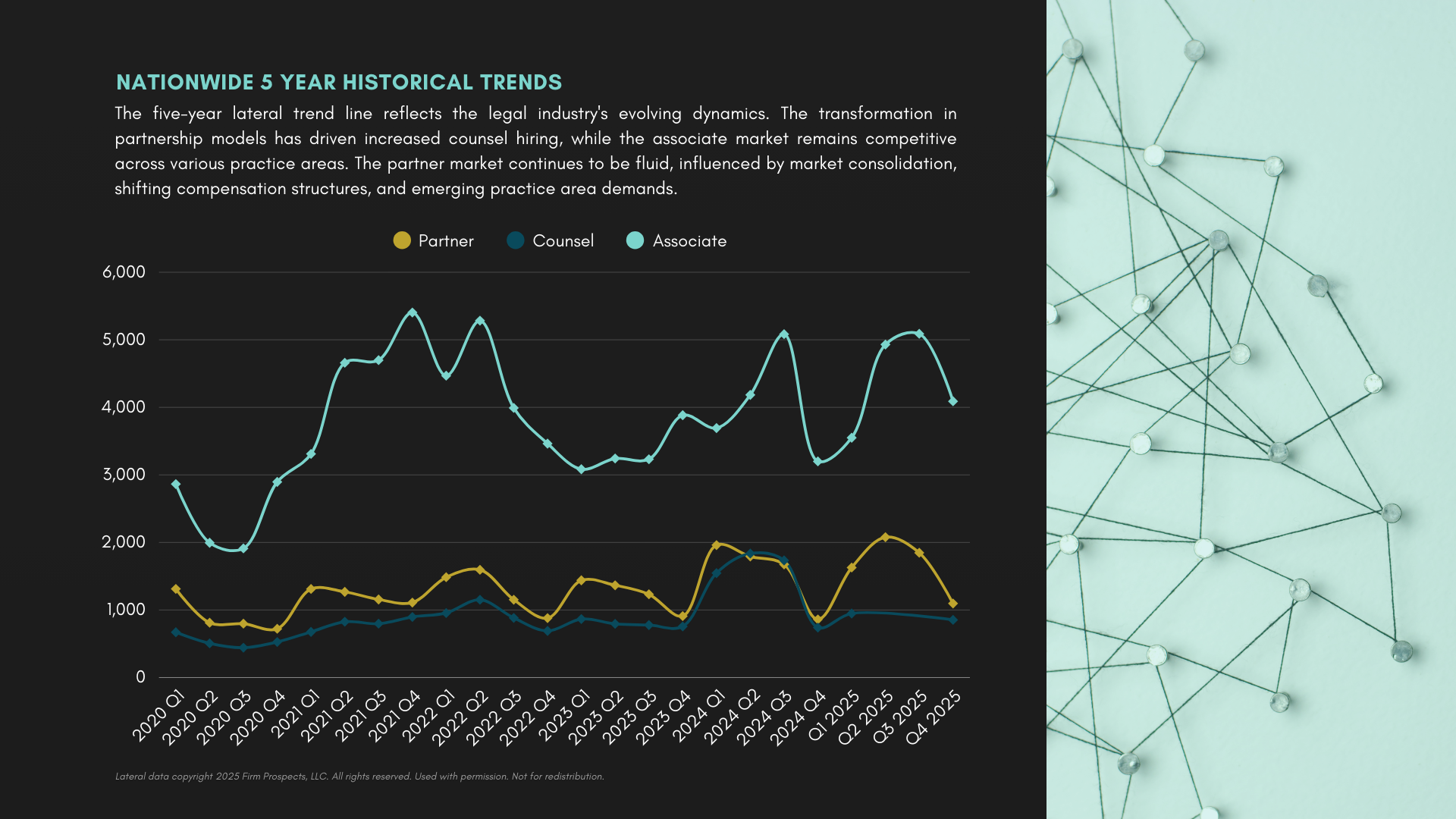

Despite uncertainties, the lateral market held steady, with only 2% fewer moves compared to 2024. Trendlines related to elevated partner and group moves, title changes with lateral movement and mid-levels accounting for ~30% of associate moves continued.

This report takes a look back at 2025’s lateral market and a practical look at what 2026 may hold for legal professionals.

Top Stories: Political Pressure and Structural Shifts

The legal industry faced internal and external shocks that are still being resolved.

The "EO Surprise": The administration's executive orders targeting specific law firms were widely viewed as a campaign to coerce firms into abandoning specific clients or causes. While some firms chose to cut deals to avoid fallout, others—and the American Bar Association—fought back in court to protect the rule of law and the right to counsel.

Global Consolidation: 85 mergers were announced in 2025. Many of these combinations were driven by a desire to reach "global elite" status. Firms are finding that to compete for the highest-value "mega-deals" (those over $10 billion), they need a massive international footprint and a diverse range of high-end practices.

2025 Market Lookback: Normalization and Advancement

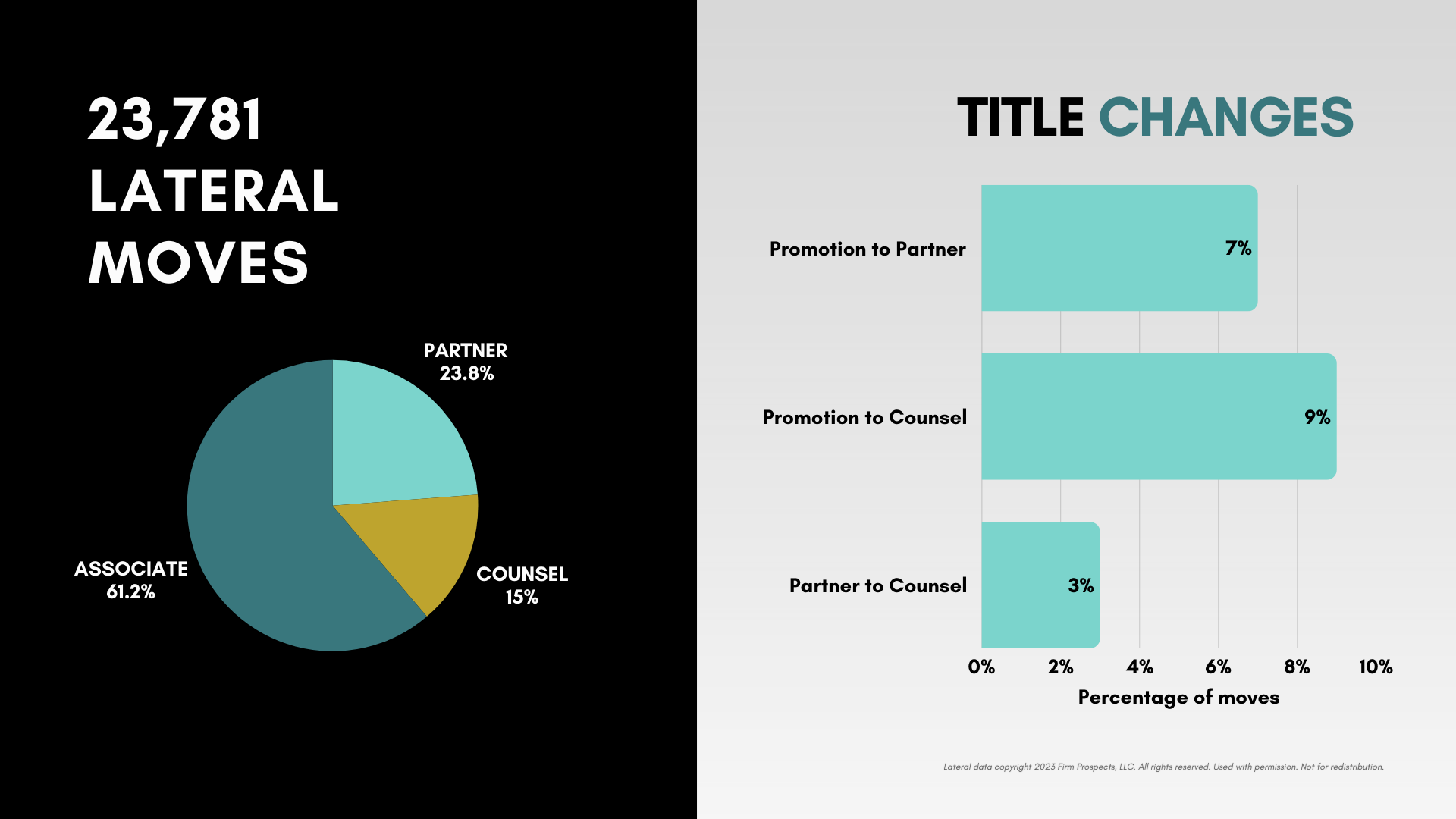

There were 23,781 lateral moves in 2025, representing a sustainable lateral pace amidst uncertainty.

The Hunger for Mid-Level Talent: This group accounted for nearly 29% of all moves, reflecting continued high demand for associates who can handle substantive work independently.

The Promotion Engine: Lateral moves have become a primary way to bypass internal bottlenecks. Common title changes included associates moving into counsel roles and counsel and associate attorneys securing partner titles. Additionally, nearly 16% of attorneys used their move to switch practices entirely, seeking out higher-demand groups or better long-term prospects.

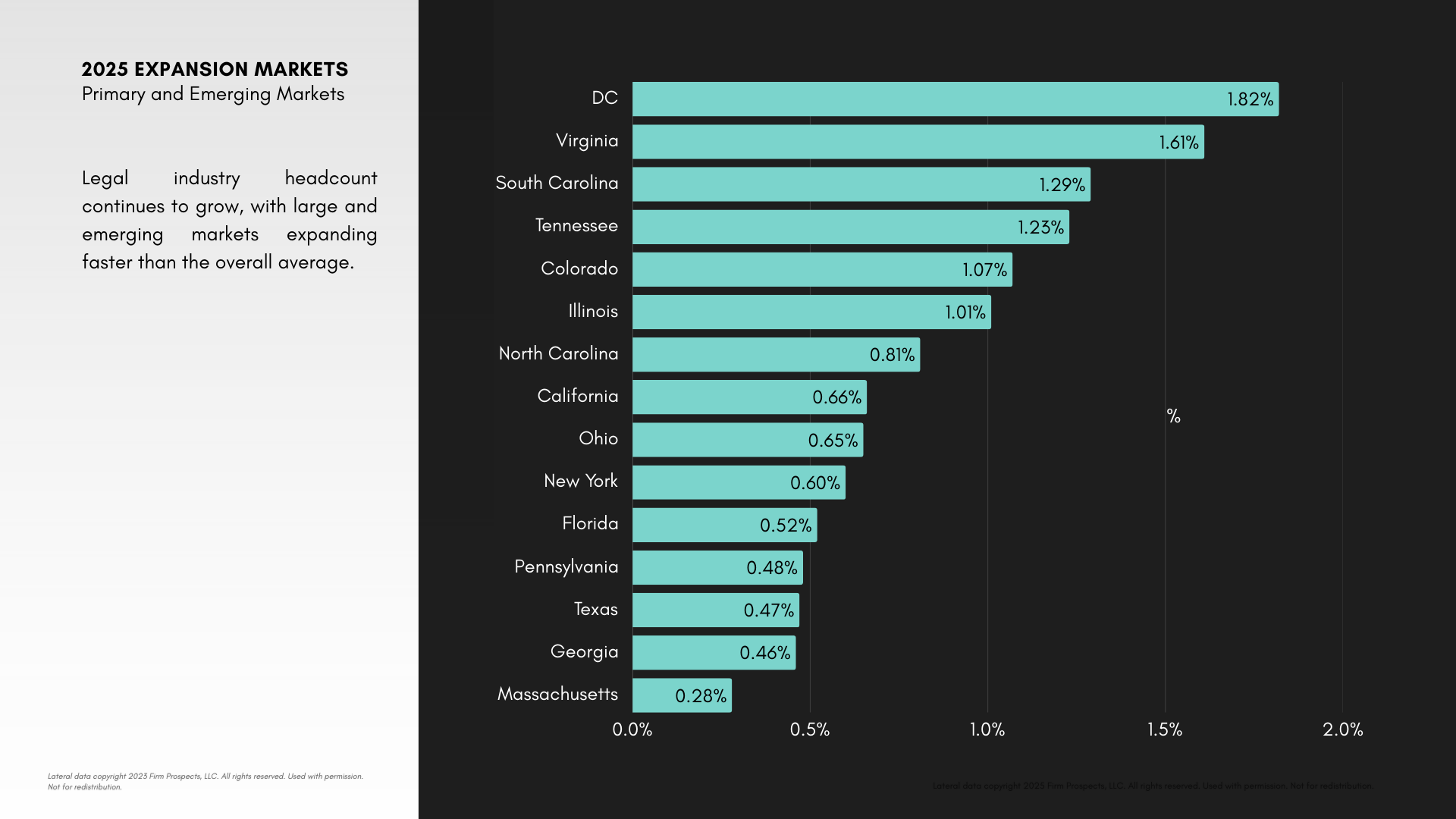

Regional Growth Drivers: Virginia and D.C. didn't just grow by accident. The surge in these markets is tied to the heavy concentration of regulatory and infrastructure work centered around the capital and the growing data center hubs in Northern Virginia.

Practice Drivers

Based on the 2025 data, we are seeing clear signals about where the market was and where it is going. Below is an analysis of the specific drivers behind the activity in these key practice areas.

Litigation

Volume: 8,880 total moves.

The "Why": Litigation remains a consistent engine of lateral movement because the nature of disputes has shifted toward high-stakes, "bet-the-company" matters. In 2025, corporate clients faced increasingly complex claims—particularly in cybersecurity, class actions, and regulatory enforcement—forcing them to increase spending on outside counsel. This demand for specialized defense capabilities drove firms to aggressively recruit partners and associates with trial experience, especially as economic uncertainty often leads to a rise in commercial disputes.

Corporate (M&A and Private Equity)

Volume: 3,213 total moves.

The "Why": After a quieter period in 2023 and 2024, the corporate market in 2025 entered a "get-back" phase. The resurgence in deal flow was primarily driven by Private Equity sponsors deploying accumulated capital that had been sitting on the sidelines. Additionally, a stabilization in the interest rate environment encouraged a return to deal-making, pushing firms to reload their associate ranks to handle the increased transaction volume.

Banking & Finance

Volume: 1,164 total moves.

The "Why": Banking showed a 56% year-over-year increase in moves in 2025. Private credit and alternative lending structures, which have eclipsed traditional bank lending in many sectors, helped fuel this surge. As financial markets adjusted to the 2025 interest rate outlook, borrowers and lenders moved quickly to refinance and restructure debt, creating an immediate need for attorneys with expertise in secured and structured finance.

Intellectual Property

Volume: 1,413 total moves.

The "Why": The 2025 IP market was defined by the intersection of technology and regulation. We saw a spike in litigation and advisory work related to Artificial Intelligence (AI), specifically concerning copyright and authorship of AI-generated content. Simultaneously, traditional patent wars in the semiconductor and telecommunications (5G) sectors remained active, sustaining demand for attorneys with technical backgrounds to navigate complex infringement cases.

Labor & Employment

Volume: 2,034 total moves.

The "Why": This practice area remains active due to a constantly shifting regulatory environment. In 2025, employers faced new state-level compliance hurdles—such as amendments to fair employment laws—alongside continued wage and hour scrutiny. As companies navigated return-to-office mandates and evolving hybrid work policies, they required sophisticated counsel to manage the resulting employee friction and potential litigation.

Health Care

Volume: 421 total moves.

The "Why": Activity here is driven by aggressive government enforcement and consolidation. The Department of Health and Human Services (HHS) and the Office of Inspector General (OIG) ramped up audits in 2025, particularly regarding remote patient monitoring and billing fraud. On the transactional side, Private Equity continued to invest heavily in physician practices and healthcare infrastructure, requiring a hybrid skill set that combines corporate deal-making with regulatory compliance.

Tax

Volume: 445 total moves.

The "Why": Tax hiring in 2025 was largely a derivative of the corporate recovery. As M&A and Private Equity deal flow returned, so did the need for tax attorneys to structure these transactions efficiently. Furthermore, looming expirations of certain tax credits and potential legislative changes require companies to seek high-level strategic tax advice.

Key Market Expansions

Legal industry headcount continues to grow, with large and emerging markets expanding faster than the overall average.

New York: The Hub for Mega-Deals

New York remains the primary engine for high-end transactional work. In 2025, the market saw 5,361 lateral moves. Although its per capita growth of 1.87% is lower than that of smaller hubs, the concentration of "mega-deals" (those valued over $10 billion) keeps the city's elite firms in a constant battle for talent.

Market Driver: The drive for "global elite" status is most visible here, as firms merge or aggressively hire to handle massive international M&A and complex finance.

Candidate Impact: For attorneys in New York, the market remains heavily focused on those who can manage high-stakes, multi-jurisdictional matters.

California: Tech, AI, and Novel Litigation

California saw 3,798 lateral moves in 2025, representing a per capita growth of 1.29%. The market is currently being shaped by two distinct forces: the rise of artificial intelligence and a surge in consumer-focused litigation.

Market Driver: San Francisco has become a testing ground for new litigation theories, particularly those involving ultra-processed foods and environmental claims.

Candidate Impact: There is a sustained need for attorneys who can bridge the gap between technical science and legal policy, especially as AI adoption moves from experimentation to data infrastructure readiness.

Texas: The Data Center Land Mass

Texas is quickly becoming the national leader for energy and infrastructure work related to the AI boom. With 2,110 moves and a 1.53% per capita growth rate, the market is feasting on the massive investment in data centers.

Market Driver: The state's deregulated electricity market and favorable tax incentives have made Texas the "largest data center land mass" in the country.

Candidate Impact: Firms with energy pedigrees are looking for associates and partners who understand land use, power grid regulations, and secured finance.

Charlotte: The Epicenter of Internal Movement

Charlotte is a dominant sourcing and destination hub for lateral talent. In 2025, it accounted for roughly 77% of all moves within North Carolina, driven by its deep roots in banking and finance and multiple offices.

Market Driver: Banking saw a 56% year-over-year increase in lateral moves, and it is the most active practice in the city. The increased banking movement in Charlotte in 2025 can be partially attributed to several new office openings, anchored by banking practices.

Candidate Impact: Charlotte remains a highly stable market with significant internal circulation, offering a more affordable cost of living while still handling sophisticated financial work.

Raleigh: The Strategic Hub

Raleigh is increasingly seen as a destination for attorneys relocating from larger markets or shifting from Charlotte. It saw a modest but notable increase in destination moves in 2025.

Market Driver: The city benefits from an expanding technology and life sciences business base, and has a strong per capita arrival rate of 2.40%.

Candidate Impact: Raleigh offers a strong alternative for those seeking growth in corporate, real estate, IP and litigation practices outside the traditional, finance-heavy hubs.

Georgia: Steady Regional Expansion

The Atlanta market recorded 750 lateral moves in 2025 with a per capita growth rate of 1.47%.

Market Driver: Atlanta continues to grow as a regional powerhouse for Labor & Employment and Insurance practices, which have remained consistent performers even amid broader market shifts. Atlanta also saw several office openings, as firms view it as a natural market for expanding their strategic footprints.

Candidate Impact: The market is rewarding attorneys with sophisticated substantive experience who can support the city's diverse corporate base, ranging from technology startups to Fortune 500 headquarters.

2026 Market Outlook

The legal market in 2026 will be shaped by executive action uncertainty, regulatory overhaul, and transactional momentum. Firms that position themselves now—through both associate development and strategic partner acquisitions—will capture the work generated by these shifts.

Practice Area Outlook & Hiring Implications

Corporate M&A — High Priority

Market Signal: Q3 2025 deal volumes for North American targets hit $822.26 billion—the highest quarterly figure in 10 years. Year-to-date totals already surpass every annual total since 2015 except for 2021's record.

What to Look For in Associates:

Experience on both buy-side and sell-side transactions.

Exposure to cross-border deals (Middle East and African buyers tripled their spending on North American targets this year).

Technology sector transaction experience, particularly AI-related investments.

Ability to manage multiple workstreams and coordinate with specialists.

Partner Acquisition Opportunities:

M&A partners with established relationships with sovereign wealth funds and international investors.

Partners with technology transaction experience, given the AI infrastructure buildout.

Consider partners who can bring cross-border deal flow from the Middle East and Asia Pacific regions.

Restructuring & Bankruptcy — High Priority

Market Signal: Chapter 12 bankruptcy filings surged nearly 50% through mid-October compared to the same period in 2024. Immigration enforcement is creating labor shortages that cascade into contract failures and insolvency for industries, like family farms.

What to Look For in Associates:

Familiarity with force majeure analysis and contract interpretation.

Experience with agricultural clients or labor-intensive industries.

Understanding of 11 U.S.C. §365 (contract rejection) and §502(b) (creditor claims).

Commercial litigation background that can translate to adversarial bankruptcy proceedings.

Partner Acquisition Opportunities:

Partners who handle debtor-side and creditor-side work with diversified client bases.

Look for partners with experience in agriculture, construction, hospitality, or logistics—industries heavily affected by immigration enforcement.

Prioritize markets with strong regional bankruptcy courts.

Intellectual Property Litigation — Growing Demand

Market Signal: The International Trade Commission will see increased filings due to (1) the Lashify decision expanding the domestic industry requirement, and (2) growing skepticism in the Northern District of Illinois toward Schedule A cases involving ex parte TROs.

What to Look For in Associates:

ITC experience or strong interest in learning Section 337 proceedings.

Patent, trademark, or design patent enforcement background.

Experience handling cases against foreign defendants and jurisdictional challenges.

Partner Acquisition Strategy:

Target IP partners with ITC trial experience—this remains a niche skillset.

Look for partners serving direct-to-consumer businesses, which are projected to grow 14.5% next year.

Consider partners who can pivot between traditional district court litigation and ITC proceedings.

Regulatory & Administrative Law — High Priority

Market Signal: 158 APA suits have been filed in 2025, challenging the implementation of executive orders. Discovery requests in APA cases have hit a 10-year high, and courts are increasingly allowing plaintiffs to take discovery, including deliberative process materials.

What to Look For in Associates:

Experience with Administrative Procedure Act litigation.

Background in government investigations or enforcement defense.

Familiarity with injunctive relief and preliminary relief standards.

Understanding of executive authority and constitutional law arguments.

Partner Acquisition Opportunities:

Partners with experience challenging or defending agency actions.

Prioritize those with established relationships with trade associations or industry groups likely to bring APA challenges.

Look for former government attorneys with agency experience.

Labor & Employment — Strategic Opportunity

Market Signal: The NLRB may be declared unconstitutional following the SpaceX case. If the Supreme Court strikes down the board's structure, a regulatory void will emerge. New York and California have already passed laws allowing state agencies to hear private-sector labor disputes.

What to Look For in Associates:

Traditional labor law experience (union negotiations, ULP proceedings).

Multi-state employment counseling capability.

Familiarity with state labor agency processes in New York and California.

Litigation experience for the wave of challenges that may follow.

Partner Acquisition Opportunities:

Labor partners who can advise clients through regulatory uncertainty.

Prioritize partners with state-level labor board experience, particularly in states establishing their own enforcement frameworks.

Consider building out labor capacity in New York and California, specifically.

Digital Assets & Cryptocurrency — Growth Area

Market Signal: The SEC is proposing six crypto-related rules and has adopted a more crypto-friendly posture. Digital asset treasuries (DATs) are proliferating—over 80 were created in 2025—and litigation over DAT mergers is beginning.

What to Look For in Associates:

Securities regulatory background with interest in digital assets.

M&A experience that can translate to DAT merger disputes.

Shareholder litigation experience (valuation disputes will drive claims).

Comfort with emerging technology and blockchain concepts.

Partner Acquisition Strategy:

Target securities partners who have developed crypto practices.

Look for partners who can handle both transactional work (helping clients navigate new SEC rules) and litigation (defending against shareholder challenges).

Prioritize partners who have relationships with crypto exchanges, mining companies, or fintech firms.

Healthcare & Pharmaceutical Regulatory — Steady Demand

Market Signal: The 340B Drug Pricing Program is facing new challenges. Drugmakers recently won their first court victory in West Virginia, and the Trump administration launched a rebate pilot program that shifts financial risk to hospitals and clinics.

What to Look For in Associates:

Healthcare regulatory experience, particularly with HHS and HRSA.

Understanding of drug pricing structures and Medicaid rebates.

Litigation experience for the contract pharmacy access disputes.

Familiarity with hospital and health system operations.

Partner Acquisition Opportunities:

Partners who represent either drugmakers or covered entities (hospitals/clinics).

Prioritize partners with appellate experience—several circuit courts will likely weigh in.

Consider partners who can advise on compliance with evolving rebate structures.

Financial Services & Banking — Compliance Focus

Market Signal: Debanking executive orders are imposing new compliance pressures on banks. Financial institutions must navigate traditional safety and soundness requirements while also managing the risk of being investigated for denying services to specific customers or industries.

What to Look For in Associates:

Bank regulatory experience with OCC, FDIC, or Federal Reserve.

Anti-money laundering (AML) and Bank Secrecy Act background.

Investigations experience.

Understanding of risk management frameworks.

Partner Acquisition Strategy:

Target partners who can advise banks on navigating conflicting compliance pressures.

Prioritize partners with relationships at regional and community banks, which face acute pressure.

Consider partners with FinCEN or OCC experience.

Privacy & Artificial Intelligence — Emerging

Market Signal: No new state comprehensive privacy laws passed in 2025—a notable pause. Instead, states are focusing on AI-specific legislation (California, Texas, Pennsylvania, and Montana all passed AI laws). Colorado's comprehensive AI Act takes effect in June 2026.

What to Look For in Associates:

Privacy compliance experience (CCPA, state privacy laws).

Emerging interest in AI governance.

Data security and breach response background.

Cross-functional experience working with technology and business teams.

Partner Acquisition Strategy:

Target privacy partners who are developing AI governance practices.

Look for partners who can advise on state-by-state AI compliance.

Consider partners with experience in algorithmic decision-making and bias audits.

Strategic Advice for Leaders

The firms that will gain ground in 2026 are those acting now—not waiting for regulatory clarity or market stability. Build associate benches in M&A, restructuring, and regulatory practices before deal flow peaks and the talent pool thins. Target partner acquisitions strategically: prioritize those that bring established client relationships in high-growth sectors such as AI infrastructure, digital assets, and cross-border transactions. Pay attention to the regional shifts—Texas and Virginia are becoming centers of gravity for energy and regulatory work. Most importantly, recognize that lateral movement has become a primary mechanism for attorneys' advancement. If your internal promotion pathways are clogged, your best people will leave. Firms that invest in talent development and strategic hiring during uncertainty emerge stronger when the market stabilizes. Those who wait will spend 2026 playing catch-up.

Strategic Advice for Candidates

If you're waiting for the "right time" to explore your options, you're already behind. The 2026 market rewards those who position themselves ahead of demand, not those who react to it. Associates in their fourth through seventh years should be particularly strategic right now—you're the most sought-after group, which means you have leverage. Use it to find a platform where you can actually build a practice, not just bill hours. Pay attention to title changes with lateral moves: 16% of attorneys used their transition to elevate from associate to counsel or counsel to partner. If your current firm's partnership track is stalled, moving may be your only path forward.

For Partners, portability still matters, but firms are increasingly focused on synergistic relationships that generate new work alongside maintaining existing clients. If you're sitting on a book in a stagnant practice area, start developing adjacencies now.

The biggest mistake candidates make is treating lateral moves as something you do when things get bad. Attorneys advancing their careers are those who treat movement as a strategic asset. Know your market value, understand where demand is heading, and make your move when you have options, not when you're desperate.